Repossession Laws in Minnesota

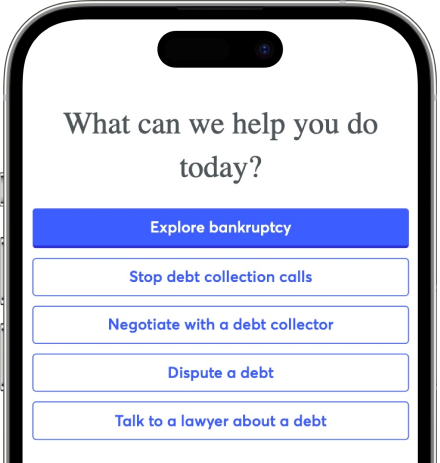

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Repossession is the process of taking back a car after the owner defaults on their auto loan. Each state has different laws and regulations that dictate every step of the repossession process from start to finish. This page will provide an overview of Minnesota's Repossession Laws and what you should know if you've fallen behind on car payments.

Written by Upsolve Team.

Updated March 22, 2024

When you purchase a car, truck, motorcycle, or ATV with financing, the vehicle itself acts as collateral to secure the loan. This means that, if a borrower fails to make their loan payments on time, the lender can seize the vehicle in repayment for what is owed. This process is commonly called repossession.

State law dictates how and when creditors are permitted to repossess an owner’s vehicle. If you live in the Land of 10,000 Lakes, you’ll want to familiarize yourself with the rights and responsibilities of both borrowers and creditors so you can know what to expect if you ever fall behind on your car loan payment schedule.

How Many Payments Can I Miss Without Risking a Repossession in Minnesota?

In Minnesota, the answer to this question isn’t straightforward. Most of the time, borrowers risk repossession if they are even a single day late on a single monthly payment. Unless the terms of your auto loan agreement explicitly say otherwise, lenders can technically repossess your car if you’re late by even one day on your car payment. That’s because they have a security interest in the car. Most lenders wouldn’t repossess a vehicle due to a single late payment — primarily because the repossession process is costly — but the risk is there just the same.

Under most circumstances, lenders won’t repossess a vehicle until a borrower is so behind on their payments that their account is in default. Default status usually kicks in when a loan payment is 90 days or more past due. But default status can vary based on the terms of an individual’s loan. For example, your auto loan may indicate that your account could be in default if you fail to buy proper insurance for your vehicle.

There are two notable exceptions to these general rules in Minnesota. First, if you file bankruptcy, your vehicle can’t be repossessed until your creditor secures permission from the bankruptcy court. Second, some borrowers aren’t at risk of vehicle repossession until they’ve been served with a Cobb Letter.

Will I Be Notified Before the Repossession? How?

Minnesota doesn’t require prior notice, except when a Cobb notice or letter is mandated. Lenders are required to provide a repossession notice to the borrower if that lender has accepted a borrower’s late payment more than once during their loan term without repossessing the vehicle. Logically, if a borrower has had their late payments accepted without a repossession before, they have a reasonable expectation that their vehicle won’t be taken without notice.

This means that if your lender has accepted your late payment at least twice without repossessing your vehicle, they must serve you with notice that they may seize your vehicle if you don’t honor the terms of your contract moving forward. A lender must send a repeat Cobb notice if they accept more late payments after they’ve sent a previous Cobb notice. The Cobb notice must be written and mailed to the borrower to meet legal requirements.

Regardless of whether you’ve received a Cobb letter, if your car has been repossessed already, your lender must provide you with written notice concerning the repossession. In that notice, they must explain how much it’ll cost to redeem your vehicle and how much time you have to redeem it before it’ll be sold at auction or otherwise disposed of.

How Can I Prevent a Repossession?

The only surefire way to prevent repossession is to remain current on your auto loan payments at all times. If you never fall behind in your payment schedule, you’ll never provide your creditor with an opportunity to seize the collateral tied to your loan.

If you’re already behind in your payments but your lender has not yet repossessed your vehicle, you have two options to avoid repossession. First, you can immediately pay off your overdue loan balance in full.

Second, you can speak with your lender to proactively set up a payment plan. Your lender may agree to a temporary deferment or may be willing to let you tack your missed payments onto the end of your loan term. You can also explore refinancing your loan or modifying its original terms with your lender. If they know that you’re catching up on your overdue payments according to specific, agreed-upon terms, they won’t repossess your vehicle as long as you stick to those terms.

If you can’t catch up on your overdue payments and you can’t reliably make your scheduled payments any time soon, you may want to speak with your lender about voluntary repossession. Surrendering your vehicle can help you avoid a hit to your credit score from a repossession. If your loan is already upside down, this may be an especially wise approach.

If you borrowed $7,500 or less to finance your vehicle and you choose voluntary repossession, you won’t be held accountable for the remainder of your balance [0].

Upsolve Member Experiences

1,739+ Members OnlineWhat Can Repo Companies in Minnesota Do?

The state of Minnesota doesn’t require repo companies to give you notice before they seize your vehicle. That said, they aren’t allowed to simply take your vehicle from any place and in any way that suits them. While they can take your car from a public place or unlocked private property, they can’t remove your vehicle from a private, enclosed space — such as a locked garage — without a court order. They also can’t breach the peace while seizing your property. Similarly, you can’t commit a breach of the peace to defend your property.

Just as a repo company can’t trick you, take your property by force, or mislead you, neither can you defend your property using force. If a repossession agent is engaging in unlawful conduct when seizing your vehicle, don’t try to stop them. Contact the authorities and a lawyer. Otherwise, you could land in hot water for breaching the peace.

What About the Personal Property in My Car?

If you’ve already missed an auto payment or two, take time to remove your personal property from your car. That way, if it’s repossessed without warning, you won’t have to hustle to retrieve it. In Minnesota, repo companies must allow you to retrieve any personal property left behind in a repossessed car. However, they can charge you for storing your personal property until you pick it up.

You aren’t entitled to retrieve anything that’s attached to the vehicle once it’s repossessed. That property is considered part of the car. So if you’ve upgraded your stereo system, for example, you might want to remove that proactively, too.

In Minnesota, repossessors are supposed to inform you that you’re entitled to retrieve your personal property from a seized vehicle. But if they don’t, you may need to connect with your creditor to get contact information for the repossession company so you can get your stuff back.

What Happens After a Repossession in Minnesota?

Under Minnesota repossession laws, lenders aren’t necessarily required to sell a vehicle at auction once they repossess it. If they’re not selling it, they must notify you of how much time you have to redeem your vehicle.

If your lender chooses to sell your vehicle at a public sale, they must provide you with notice of both the time and place of the sale. If they choose to sell it privately, they must provide you with notice of the date it’s being listed for sale. In either event, proceeds from the sale will go toward covering your outstanding total balance. This includes your payment balance, fees, and auto repossession costs.

If your creditor opts to keep your vehicle and cancel your debt, you can formally object within 30 days of the repossession to force a sale. It’s generally a good idea to speak with an attorney before taking this course of action. A lender can’t lawfully keep your vehicle and cancel your debt if you’ve already paid off 60% or more of the vehicle’s purchase price.

No matter how your creditor chooses to treat your vehicle after it’s repossessed, the vehicle’s certificate of title will be transferred back to the lender unless you redeem the car.

Do I Still Owe After a Repossession in Minnesota?

Unless your lender chooses to keep your vehicle and cancel your debt, you’ll remain responsible for paying off any deficiency balance on your account after the sale of your vehicle. Essentially, if the sale price of the vehicle doesn’t cover your total outstanding balance, you’re responsible for paying the remainder owed unless the total credit extended for your loan was $7,500 or less. If you owe a deficiency balance and no other exceptions apply, you’ll be required to pay it off even if you voluntarily surrendered your vehicle.

If you don’t pay the deficiency balance, your lender could seek a judgment against you in court to garnish your wages or impose a bank levy on your account. Both actions will show up on your credit report and hurt your credit.

Can I Get My Car Back After a Repossession in Minnesota?

If you want to redeem your car after it’s been repossessed, you’ll likely be required to repay the full balance you owed plus repossession costs and fees. Some lenders may be willing to arrange a repayment plan that doesn’t require you to pay the balance in full, but this isn’t guaranteed. If you’re thinking about taking out a new loan to pay off your vehicle, act quickly because navigating your financial options takes time.

Where Can I Find More Information About Repossession Laws in Minnesota?

Minnesota takes a unique approach to the repossession process due to its Cobb requirement and a few other nuanced legal features other states don’t have. As a result, if you’re risking repossession or your vehicle has already been repossessed, you’ll want to connect with an attorney or a local legal aid service office to clarify your rights and explore your legal options. The following Minnesota resources may be of help to you:

Free Legal Advice Clinic, provided by the Minnesota Judicial Branch

Sources:

- Official Publication of the State of Minnesota. (2022, June). MINNESOTA STATUTES 2021. Official Publication of the State of Minnesota. Retrieved June 15, 2022, from https://www.revisor.mn.gov/statutes/cite/325G.22/pdf