What Is Chapter 7 Bankruptcy & When Should I File?

Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

Chapter 7 bankruptcy is a common legal process to clear your debt, but it’s not right for everyone. One good question to ask yourself if you’re considering Chapter 7 bankruptcy: Do I have more debt than I’ll ever be able to pay back, given my current income and property? If the answer is "yes," then Chapter 7 bankruptcy may be the right option.

Written by Kristin Turner, Harvard Law Grad. Legally reviewed by Attorney Andrea Wimmer

Updated April 16, 2024

Chapter 7 bankruptcy is a powerful legal tool that allows you to completely erase many debts, including credit card debt, medical debt, car loans, payday loans, and (in some cases) student loans. Experts estimate that over 39 million Americans have filed for bankruptcy.[1] In 2023, personal (nonbusiness) bankruptcy filings were up by over 12%. Filing for bankruptcy is more common than most people think.

One good question to ask yourself if you’re considering Chapter 7 bankruptcy: Do I have more debt than I’ll ever be able to pay back, given my current income and property? If the answer is "yes," then Chapter 7 bankruptcy may be the right option.

What Is Chapter 7? How Does It Work?

In a Chapter 7 bankruptcy, you fill out forms about what you earn, spend, own, and owe. Then you submit these forms to the Bankruptcy Court along with recent tax returns and pay stubs, if you’re employed.

A bankruptcy trustee will review your forms and documents. They'll also hold your 341 meeting of creditors, where they’ll ask you basic questions about your financial situation.

A couple of months later, you’ll get a notice in the mail from the court letting you know that the court has granted you a bankruptcy discharge. The Bankruptcy Court accepts most personal bankruptcy petitions and erases all eligible debt for the majority of people who fill out their bankruptcy forms accurately and complete all required steps.

What Debt Can Be Erased in Bankruptcy?

Chapter 7 bankruptcy can erase the following common debts:

Medical bills

Car loan deficiencies

Personal loans and payday loans

Judgments from credit cards and debt collection agencies

Utility bills

(Most) federal student loans

These debts are known as dischargeable debts.

The moment someone files bankruptcy, the automatic stay goes into effect. This temporarily stops anyone from collecting any debts you owe them.

What Debt Can't Be Erased in Bankruptcy?

Chapter 7 bankruptcy cannot erase the following types of debts:

Child support and alimony

Recent tax debts and other debts you owe the government like fines

These debts are known as non-dischargeable debts.

Secured debts are debts that are connected to a specific property, like a mortgage is connected to a house and a car loan is connected to a specific car. If you want to keep your property that secures a debt, you'll have to continue paying on the debt. Before you file, you must also make sure you’re current on your debt payments. If you’re willing to give up the property, then Chapter 7 bankruptcy can erase the debt.

Can Bankruptcy Erase Student Loan Debt?

There's a common misconception that student loan debt can't be erased in personal bankruptcy, but that's untrue. In late 2022, the U.S. Departments of Justice and Education made changes to the bankruptcy guidelines that have made it easier to discharge federal student loans in bankruptcy. The good news for struggling student loan borrowers is that the majority of student debt in the U.S. comes from federal student loans.

Private student loans can also be discharged in bankruptcy, but the process is more complicated. You must file an adversary proceeding, which is run like a trial. Because of this, many experts recommend hiring a bankruptcy attorney to help discharge private student loan debt in Chapter 7 bankruptcy.

Who Qualifies for Chapter 7 Bankruptcy? Should I File?

There is a difference between who is allowed to file and who should file.

Most people who earn under the median income for their state, based on their household size, are able to file. This is because they pass the means test according to bankruptcy laws. The means test takes into account your average monthly income over the last six months.

If you don’t have a job or earn near the minimum wage, you will likely qualify for Chapter 7 bankruptcy. If you don't pass the means test, you can file a Chapter 13 bankruptcy but not Chapter 7.

Folks looking for a fresh start typically fall into one of three categories:

Those who should file for Chapter 7 bankruptcy right now

Those who should wait a little bit of time and then file for Chapter 7 bankruptcy

Those who should not file for Chapter 7 bankruptcy

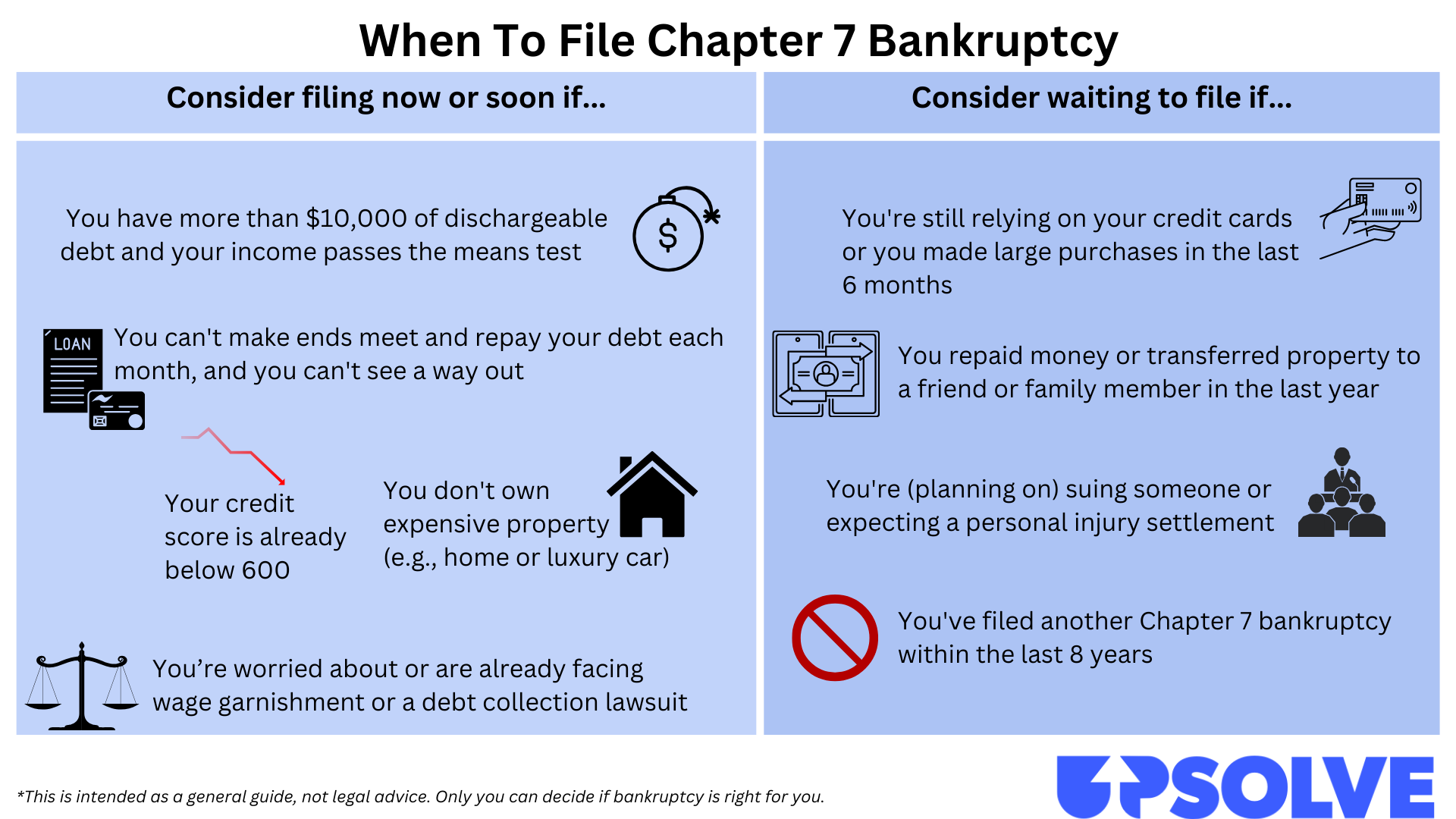

When Should I File Chapter 7 Bankruptcy? Right Now?

Some signs that you may be a good fit for filing bankruptcy now:

You have more than $10,000 of dischargeable debt

Your credit score is already low (below 600)

You don’t own expensive property

Keeping up with payments is making it impossible to make ends meet every month

You’re worried about or are already facing wage garnishment or a debt collection lawsuit

You pass the means test because you earn under the median income in your state

You don’t see a way of being able to pay back your debt over the next five years

If these apply, right now may be the right time to file for bankruptcy.

Who Should Wait To File Bankruptcy?

Some things complicate a Chapter 7 bankruptcy, so waiting a little bit of time can help. If you're still relying on your credit cards to make ends meet or you've made large purchases in the last six months, then it's best to wait to file and pay off your most recent charges first.

If you paid back or transferred property to a family member or friend in the last year, then it’s best to wait to file, if you can. You have to disclose these activities in your bankruptcy paperwork and your trustee will ask you about them.

If you're suing someone or planning to sue someone, then it’s best to hold off on filing bankruptcy until you know the final outcome of that case, if possible. People often delay Chapter 7 bankruptcy if they’re expecting a personal injury settlement.

Also, if you owe your landlord money and you don't plan to move, try to catch up on missed rent payments before filing. The same generally goes for car loans, if you want to keep the car.

Finally, if you expect your financial situation to get worse, then you may want to delay your filing. You can only file Chapter 7 bankruptcy once every eight years, so you don’t want to file if you know that you’re going to fall into more debt.

Can I Keep My Property if I File Chapter 7 Bankruptcy?

95% of Chapter 7 bankruptcy filers keep all of their property.[2] The Bankruptcy Code (the law governing bankruptcy) includes exemptions that allow you to keep several types of property, such as cash, clothes, furniture, and cars up to a certain dollar amount.

The specific exemptions you can use to keep your property depend on your state. Many states have wildcard exemptions that allow you to keep any property as long as it’s worth less than a certain amount. If your state permits it and you choose to use the federal bankruptcy exemptions, you can protect up to $1,475 with the wildcard exemption plus an additional $13,950 if you don't use the homestead exemption.

If your property value exceeds the exemption limit that applies, the trustee may seize the property and sell it to pay back your creditors. This is why people call Chapter 7 a liquidation bankruptcy, although any liquidation rarely takes place.

Property that isn’t protected by exemptions is considered nonexempt property. The most common forms of nonexempt property are expensive cars and homes.

Upsolve Member Experiences

1,766+ Members OnlineHow To File Chapter 7 Bankruptcy

Filing Chapter 7 bankruptcy involves collecting information about yourself (your income, your expenses, what you own, and who you owe) and using this information to fill out your bankruptcy forms.

Whether you plan on filing now or aren't sure yet, check out Upsolve's 10-Step Guide on How To File Bankruptcy for Free to learn more about how to prepare for and file a Chapter 7 bankruptcy case.

How Long Does Chapter 7 Bankruptcy Take?

Most people can file their bankruptcy forms in one week if they’re organized. The 341 meeting with the trustee who oversees your case takes place about one to two months after you file.

If all goes well, two to three months after your meeting with your trustee, you’ll get a letter in the mail that your debt is officially discharged. This means that that Chapter 7 bankruptcy from beginning to the discharge of your debts takes about 3-5 months.

How Much Does Chapter 7 Bankruptcy Cost?

The bankruptcy court is a federal court and requires a $338 filing fee. If you earn below 150% of the Federal Poverty Line, you may qualify for a fee waiver. People who are on Social Security or unemployed usually qualify for a fee waiver. You can pay the fee in installments if you make a request and the court agrees.

The two required education courses each cost between $10 and $50, depending on the credit counseling agency you choose. You can also qualify for a fee waiver for these courses, based on your income.

If you hire an attorney, the most expensive cost in bankruptcy is your attorney fee. It costs an average of $1,500 to hire a bankruptcy attorney for a Chapter 7 case.

Life After Bankruptcy: How Long Does Chapter 7 Bankruptcy Stay on Your Credit Report?

Most people who file Chapter 7 bankruptcy feel a sense of relief that all of their credit card and medical debt, along with other dischargeable debt, is totally gone. Many people see their credit scores improve if they had credit scores in the sub-600 range.

The bankruptcy process often creates a new sense of confidence, where people feel more comfortable with their financial affairs than when they began. Part of the reason is the two required personal finance courses. Chapter 7 bankruptcy also forces you to reflect on your financial situation.

People who file Chapter 7 bankruptcy usually get more serious about budgeting, saving, and rebuilding their credit, using tools like credit builder loans and secured credit cards.

Chapter 7 bankruptcy stays on your credit report for 10 years, but many people who file see their credit improve and are able to get approved for a mortgage within a few years if they make good financial decisions post-bankruptcy.

Chapter 7 vs. Chapter 13 Bankruptcy: What's the Difference?

The main difference between Chapter 7 and Chapter 13 bankruptcy is that in Chapter 13 bankruptcy, you don't immediately erase any debts. You propose and follow a repayment plan based on your ability to repay certain debts. The bankruptcy trustee and all creditors will review your plan and, if they accept it, the court will confirms your repayment plan. These plans last three to five years.

Most people file Chapter 13 bankruptcy instead of Chapter 7 for two reasons.

They failed the means test due to their high income and don’t qualify for Chapter 7 bankruptcy.

They own a home they want to keep that’s not covered by the Chapter 7 bankruptcy exemptions.

If you're considering filing Chapter 13 because you don't pass the means test, look at the reasons you aren't passing. The look-back period for the means test is six months, so if you recently experienced a drop in household income, you might qualify for Chapter 7 in the near future.

Are There Any Alternatives to Bankruptcy?

If bankruptcy isn't right for you, there are other options that may help you get the fresh start you need. The one that's right for you will depend on your financial situation and the types of debts you owe. Let's go over each option.

Explore Debt Settlement

You can negotiate with your creditors. If you've fallen behind on payments or are about to, you can contact your creditor to discuss the issue. You may be able to work out an affordable payment plan or negotiate a debt settlement for less than the full amount owed. This is especially true with credit card debt. Typically, a settlement needs to be paid in a lump sum.

Consider a Debt Management Plan

Entering into a debt management plan with an agency is another option. Unlike in debt settlement, a debt management plan involves paying back your debt over time on more doable terms than you have now. Typically only unsecured debts can be included in a debt management plan.

Check Out Debt Consolidation

You may also be able to take out a debt consolidation loan to pay off your debts and get some debt relief. When you consolidate your debts, you only have to make one monthly payment to a new creditor, often at a lower interest rate than your previous loans or debt.

Let's Summarize...

Whether you should file for Chapter 7 bankruptcy depends on your financial situation and what other debt relief options are available to you. It's also important to consider the timing of filing. Taking a credit counseling course or getting a free evaluation from a bankruptcy attorney are great starting places to learn more about your options.

For more information on filing bankruptcy, including an overview of the different types of bankruptcy, head on over the Bankruptcy Basics section in our Learning Center.

Sources:

- American Bankruptcy Institute. (2019, December). Bankruptcy Grab Bag of Fun Facts. ABI Journal. Retrieved September 14, 2020, from https://www.abi.org/abi-journal/bankruptcy-grab-bag-of-fun-facts

- American Bankruptcy Institute. (2002). Bankruptcy by the Numbers - Chapter 7 Asset Cases. ABI Journal. Retrieved August 4, 2020, from https://www.abi.org/abi-journal/chapter-7-asset-cases