How Does The Repo Man Find Your Car?

Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

Vehicle repossession occurs when a lender takes a car back from a borrower when the borrower falls behind on loan payments. If you are concerned that your car may be targeted for repossession, there are things you can do to lower your risk of missing payments. Read more to learn what a repo man can and can't do, what happens after repossession, and what steps you can take to avoid repossession in the first place.

Written by Attorney Thomas J. Pearson.

Updated April 5, 2024

An auto lender can repossess your car if you fall behind on your car loan payments. A repo can happen very quickly and without much notice. It’s important to understand how repossession works and how you can manage this situation successfully. This article will explain how repo agents can find your car and take it. You’ll also learn about your rights, options, and things to consider once your car has been repossessed.

What the Repo Man Can Do To Find Your Car

Many people use auto loans to buy their cars. This means that a lender, like a car dealership or credit union, pays for a borrower's car upfront. In return, the borrower must make payments to the lender until the loan balance is paid off. In many states, lenders can repossess a borrower's car after just one missed payment.

Vehicle repossession occurs when a lender takes a car back from a borrower when the borrower falls behind on loan payments. Lenders use the threat of repossession to make sure that borrowers pay their auto loans. Oftentimes, lenders hire other companies to complete the repossession process.

How Do They Know Where Your Car Is?

Repossession companies are relentless. Car repossession agents, or “repo men,” are hired to use every tool possible to find and take cars back from car owners who are behind on their auto loan payments. They can show up with a tow truck and seize your car without warning. Repo men have access to a lot of information about car owners from their loan applications, which usually include home and work addresses. This makes it very easy for them to track down your car if they have been told to repossess it. If they don’t find your car at your home or work, they will search your home and work neighborhoods.

The repo man can also use any and all public information to track down your vehicle. It doesn’t matter who posted the information about you. It’s fair game. For example, if you post a picture on social media at your favorite restaurant, the repo man might start keeping an eye on that restaurant. If your friend tags you on a social media post, repo men might start watching your friend’s social media to track down your car.

Today, repo men use all kinds of technology to track down cars. Some car dealers install GPS tracking devices on cars they sell. These trackers show the repo man exactly where your car is at all times. This means that if you miss one payment, the repo man might be able to track you down immediately to repossess your car. Repo companies also use license plate scanners that identify cars that lenders are trying to repossess. Vehicle repossession companies regularly go through public parking lots to scan license plates and search for cars that they can take.

Repo men can seize your car from any open, public space, like the parking lot of your favorite restaurant or grocery store. This means that if you’re behind on car payments, your car could be repossessed without warning whenever it’s parked in a public space.

If you're behind or “past due” on your car loan, you're probably worried about repossession. Educating yourself and taking the right steps can ease some of the stress and uncertainty of a looming repossession.

What The Repo Man Isn’t Allowed To Do

As you can see, the repo man can do a lot of things to track your car down and repossess it. But repo men don’t have unlimited power. All states have some rules limiting the ways repo agents can track and take your car.

For example, it’s usually illegal for repo men to take a car from a locked garage or gated property. Also, repo companies aren’t entitled to keep the owner’s personal property left in the car. They must give the car owner an opportunity to get their belongings back. Note that this rule applies to portable property, like car seats and books. If you’ve made improvements to the car that are now “part” of the car (upgraded stereo equipment, etc.) you aren’t generally entitled to take your improvements back.

Has the repo man violated any of these rules? Do you feel like your car has been illegally repossessed? If so, you should report the incident to your local law enforcement, as well as the state attorney general's office. You should also consider contacting a private attorney.

Upsolve Member Experiences

1,739+ Members OnlineWhat Happens After the Repo Man Takes Your Car?

You still have some rights after a repo man repossesses your car. After repossession, you should receive notices that inform you of where your car is being held and how much you still owe for the car. The lender is also required to notify you if they decide to sell the car in a public or private auction.

In many states, if the lender decides to sell your car in a public auction, they must tell you the time and place of the auction, so you have an opportunity to bid on the car. In most public auctions, you can get your car back if you offer the highest bid. If the car is sold in a private auction, the lender usually has to notify you of the date of the sale.

You are responsible for any outstanding debt that the car sale does not cover. These costs include the remaining balance on the car loan, unpaid interest, towing fees, storage fees, auction fees, and other fees. If the auction sale doesn’t pay for all of those costs, the lender can sue you for the leftover amount (the deficiency) and receive a judgment for the deficiency.

In many states, you can redeem the car by making a large payment to the lender or by reinstating the loan. This process is called redemption. States have different rules for redemption. You should make sure that you understand your state's specific rules before making any big payments. You should also be realistic about the decision to redeem. If you still can't afford the car payments, reinstating the loan might put you in another stressful financial situation.

What To Do When You’re Worried About Car Repossession

If you think that you’re going to have trouble keeping up with upcoming car payments, you should contact your lender to discuss your options. Your lender might agree to create a new payment plan, defer payments, or refinance the loan so that you don’t miss any payments and risk repossession. You can also consider selling your car to pay off the debt and avoid repossession costs.

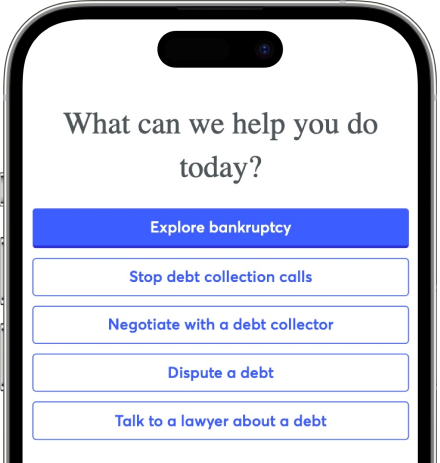

Bankruptcy could also be an option if you’re worried about missing car payments. If you file for bankruptcy, you’ll still owe whatever the car is worth, but this action will stop your car from being repossessed. Bankruptcy will also give you more freedom from other debts so you can focus on your car payments.

Whatever you decide to do, you shouldn’t miss payments without first contacting the lender. You also shouldn’t try to hide the car from the repo man because doing so will only increase the amount of debt you owe. Before your car is repossessed, upcoming loan payments add to the loan balance and interest continues to increase the total amount owed.

Let’s Summarize...

Car repossession is not easy to deal with. Anticipating a repossession can also be very stressful. It’s always best to contact your lender about missing a payment or past-due payments before you resort to other options. You also shouldn’t hide your car from the repo man. If you’re in danger of losing your car to repossession, contact a local lawyer to help you figure out what your options are.