What Do I Do About My Car Payment That Is Way Too High?

Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

If you're like most people, you had to take out a loan to buy your car. Car loan payments usually rival health insurance, student loans, and housing payments for the highest expenses. This article will cover your options to reduce your car payment with or without bankruptcy.

Written by Lawyer John Coble.

Updated August 1, 2023

If you're like most people, you had to take out a loan to buy your car. Car loan payments usually rival health insurance, student loans, and housing payments for the highest expenses. This article will cover your options to reduce your car payment without bankruptcy as well as in a bankruptcy.

How Did My Car Payment Get So High?

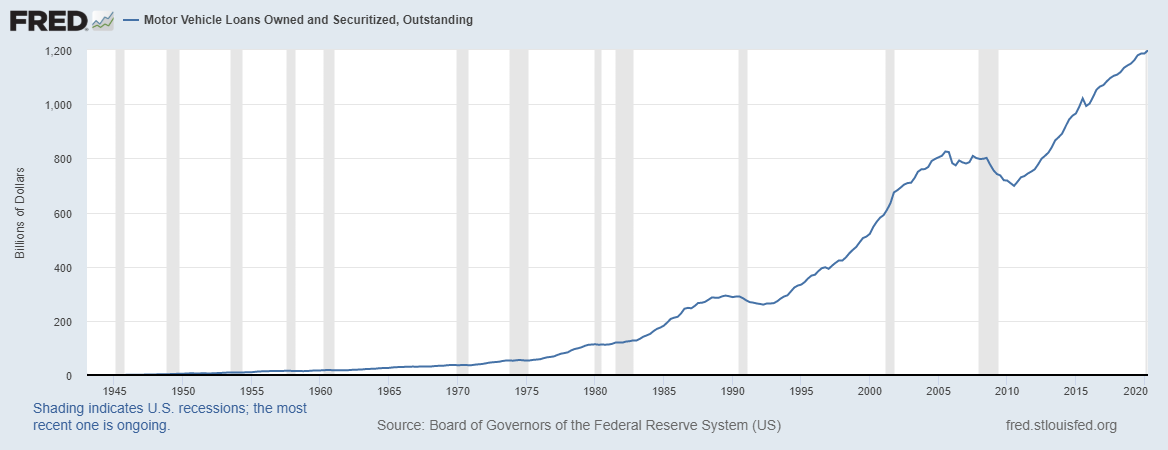

Most people have car loans. Most people have large car loans. If you rent your home, your car is probably the most expensive thing you own. It hasn't always been this way. See the graphic below from the Federal Reserve Economic Database (FRED).[1]

Since the 1980s, easy credit for car loans has led to most people having a large car loan. The average length of a car loan is now 69 months with loans extending out as long as 84 months.[2] Add subprime lenders into this environment and you have a recipe for the exploitation of people who are suffering from bad financial situations. Then, you have a salesperson that is trying to make a living like everyone else. Salespeople know that the best way to sell is not to emphasize the total price but push the monthly payment.

Often, the best decision when it comes to buying a car is to buy a car two to four years old that is in good condition. Then, use your tax refund as a start for savings to buy this car outright without a loan or with a much smaller loan. During the time of the year when most tax refunds are paid, it’s a little more difficult to find a good deal on a used car because many people are using their tax refund to start payments on a car. It's best to wait a few months after you receive your tax refund and then use that money for a car.

If you have a low credit score when you take out a car loan, you’ll pay a high interest rate. The interest rate makes all the difference in the total amount you will pay. For example, say you buy a car for $10,000 with no down payment and an 84 month loan. If your interest rate is 15%, then over that eighty-four months, you will pay the low price of $193.00 per month, but over those eighty-four months, with interest, you will be paying $16,209. So the $10,000 you paid for the car is really $16,209. Of course, you do still have a low monthly payment. These calculations were made using the car loan calculator at cars.com.

What happens if there is a recession and you lose your job during one of these 84 month car loans? If you lose your job, you could have a very difficult time making the payments. If you "let the car go back" to the car lender, and you are halfway through the loan, most of your payments at this point will still be interest instead of principal. Therefore, you will still owe most of the $10,000.00 principal.

Unfortunately, most cars depreciate rapidly so it's unlikely your car will raise enough money at an auto auction after repossession to pay off your loan balance. As a result, the car lender will sue you to pay the difference between what the loan balance was at the time you surrendered the car and the money it sold for at an auto auction. Then, they’ll garnish your wages to get you to pay for a car that you don't even have. It's important to avoid this scenario by paying for as much of your car as you can without a loan.

This is especially true if you have bad credit and will be subject to a high-interest rate. If you have bad credit, plan to use bonuses from work and tax refunds to pay as much as possible upfront. Then, make sure you get the best deal for a car that is within your price range. Then, take out a small loan that will be paid over a shorter period.

With the shorter loan period, there is a lower chance of something bad happening that makes it difficult to make your monthly car payment. With the smaller loan that has lower monthly payments, you may be able to make all these lower payments on time. This will be able to rebuild your credit. Then, the next time you need a new car, you will get a much lower interest rate.

The Upside Down Car Loan and Negative Equity

When you owe more money for a car than the car is worth, you're "upside-down" on the car loan. Being upside down is caused by depreciation on the car occurring quicker than the loan balance is reduced. The longer your loan term, the longer you will be upside down over the loan term. The amount by which you're upside down is called negative equity. When you trade in a car that you're upside down on, the negative equity from the previous loan is rolled into the new loan. If a down payment could be made, the negative equity could be eliminated. But, you may not have the money to make a down payment.

Many people think that when a car reaches a certain age, it's cheaper to buy a new car than to continue to make repairs. The fact is, the car age needed for this to occur is usually much longer than people realize. Most cars can be driven for several years after a loan has been paid off and the repairs will still be cheaper than buying a new car. The key to handling expensive repairs is to put money into savings each month after the warranty expires. Usually, these needed deposits into savings will be much less than a new car payment. To keep car repair costs at a minimum, it's a good idea to stick with your cars' recommended maintenance schedule. That is, get all your oil changes and tune-ups on time.

The most overlooked way of keeping your transportation costs lower is not to exceed the speed limit. On the average commute to work, speeding may get you to work two to three minutes quicker. For those extra two to three minutes, you pay an incredible price. Speeding leads to the following expenses:

Increased wear and tear on the vehicle. This is especially true for the brakes.

Lower miles per gallon for gas and therefore more paid for gas.

Increased chance of an expensive speeding ticket along with increased insurance rates due to the ticket.

There is an increased chance of an accident that will lead to expensive repairs plus higher insurance rates.

Not speeding is one of the easiest changes to help your finances.

How Can I Lower My Car Payment?

You can lower your car payment without buying a new car or even a used car. If you improve your credit, you could get a lower interest rate. Consider the example above where the interest rate was 15% and the car payment was $193.00 per month. If improvements in your credit score allow you to refinance at a lower rate of 5%, your monthly payment will be reduced to $141.00 per month. For most people, a savings of $52.00 per month ($624.00 per year) is nothing to sneeze at.

Even without improving your credit report, you may be able to get a lower interest rate by shopping around. Don't take the first interest rate you get. Think of the interest rate as part of the price. People always look for the lowest price but often don't think about the interest rate. In the example above, the difference in the 5% rate and the 15% rate is $4,368.00 for the total amount you will pay on your auto loan.

Another option you have to lower your car payment is to voluntarily surrender your current car. These surrenders are treated the same as a repossession. The lender will sell the car at an auction and it usually won't sell for enough to pay off the balance you owe to the lender. The lender will then sue you for the difference in the balance and what the car brought at auction. Though you have lowered your car payment for a while, you will end up with a new payment for your deficiency balance on the old car. On top of that, the voluntary repossession will harm your credit score and could result in a worse interest rate on your new auto loan.

Upsolve Member Experiences

1,739+ Members OnlineCan Bankruptcy Help?

Bankruptcy provides several options for dealing with a car payment that's too high. In bankruptcy, car loans are secured debts. The collateral is the car when you borrow money for a car purchase. In a Chapter 7 bankruptcy, you show how you intend to deal with your car loan on your Statement of Intention. In a Chapter 13 bankruptcy, you show your intentions to deal with your car on your Chapter 13 Plan.

Option 1 – Eliminate Your Other Debt so You Can Afford the Car

One way bankruptcy can help you with your car payment is that it will eliminate other debts leaving you with more money to make your car payment. If you're like most people, within a year of filing bankruptcy, your credit score will probably be better than the day before you filed for bankruptcy. With a better credit score, you can seek to lower your interest rate by refinancing your car. If this is your plan, in a Chapter 7 bankruptcy, you will probably want to reaffirm your car loan. A reaffirmation agreement usually keeps your car loan exactly as it was before you filed for bankruptcy. It's as if your car was not part of the bankruptcy. It is possible to negotiate a better interest rate during the reaffirmation process.

Option 2 – Redeem the Car

In a Chapter 7 bankruptcy, a less commonly used option than a reaffirmation is a redemption. With redemptions, you only pay the value of the car as opposed to the loan balance. The catch is, you have to completely pay off the car in a single payment. For most people, this can only work if they're able to get a loan while in a Chapter 7 bankruptcy. Getting such a loan is possible. There are some companies that specialize in making loans to people while in a Chapter 7 bankruptcy for the purpose of redeeming their car. Most of these companies charge high-interest rates. See the example above for the difference a few points of interest can make to the total amount you pay. Often, the high-interest rates will cause you to pay more than had you reaffirmed with the original lender.

In Chapter 13 bankruptcies, there is a process that is similar to the redemption that is far more common. This is called the "Cram-Down." Instead of paying the loan balance, you only pay the value of the car. This solves the problem of being "upside-down." To only pay the value in a Chapter 13 bankruptcy on a car loan, you must have taken out the loan more than 910 days before you filed for bankruptcy. The cram-down in a Chapter 13 bankruptcy also crams down the interest rate and you don't have to wait 910 days for the interest rate cram-down. In Chapter 13 bankruptcies, you don't have to have all your money at once in order to do a cram-down. This is because Chapter 13 bankruptcies have built-in payment plans of thirty-six to sixty months. Therefore, you pay the original lender through the Chapter 13 plan instead of getting a new high-interest loan as is done with a Chapter 7 redemption.

Option 3 – Surrender the Car

In either a Chapter 7 bankruptcy or Chapter 13, you can surrender your car and the debt is changed to a dischargeable unsecured debt. In most Chapter 7 bankruptcies, nothing is paid to the car loan company, but your debt is eliminated. This prevents the problem of deficiency balance lawsuits that occur with repossessions and voluntary returns. In a Chapter 13 case when you surrender your car, the car loan company will get the same amount as other unsecured creditors. Unsecured creditors usually get only pennies on the dollar in Chapter 13 cases.

Even in bankruptcy when you intend to surrender your car, you must maintain car insurance until you actually surrender the car. If you drop your car off at a dealership, make sure you get paperwork from the dealership that proves you dropped off the car. The downside to surrendering a car in a Chapter 7 bankruptcy is that you may have a difficult time buying a new car until your Chapter 7 bankruptcy has discharged. This is approximately four months after you file your Chapter 7 bankruptcy petition. After discharge, it is easy to get a car loan. The problem is, for the first several months to a year, it is difficult to get a good interest rate. In parts of the country, used car lots monitor the bankruptcy courts' PACER system for new discharged cases. Then, they send these people letters about their great deals on used cars. These car lots do this because they know you're a good credit risk since you eliminated your debts and therefore, have more money to pay the car lot. They also know you will be susceptible to accepting a high-interest rate. Don't let these people suck you in. Hold out until you can get a reasonable interest rate.

A Note on Credit Unions

Credit unions and some smaller banks like to cross-collateralize loans. This means they use the same collateral for multiple loans. It can also mean that multiple items are used as collateral for all your loans with the credit union. It is common for credit cards through a credit union to be secured by your car when you also have a car loan with the credit union. While credit cards are usually unsecured, this type of cross-collateralization effectively makes a credit card into a secured debt. Due to this cross-collateralization, credit unions often won't reaffirm a car loan unless the credit card is also reaffirmed. If the credit card balance is high enough, it may be best to surrender the car.

Conclusion

Since car payments are among most people's highest expense, it is normal to feel that it's too high. Refinancing, selling, or surrendering the car are options to reduce your car payment, but be careful with these options. When you refinance, shop around and make sure you get the best interest rate. You don't have to stick with your current lender. When surrendering a car realize that you're opening yourself up to a deficiency lawsuit. But, if you surrender your car while in bankruptcy, you eliminate the possibility of a deficiency lawsuit. Bankruptcy provides several other options to reduce your car payment such as redemptions in Chapter 7 bankruptcies and cram-downs in Chapter 13 bankruptcies.

Sources:

- Federal Reserve Bank of St. Louis. (n.d.). Motor Vehicle Loans Owned and Securitized, Outstanding . Consumer Credit G-19. Retrieved August 7, 2020, from https://fred.stlouisfed.org/series/MVLOAS/

- (n.d.). What Is the Average Car Loan Length?. Car and Driver Research. Retrieved August 7, 2020, from https://www.caranddriver.com/research/a31758321/average-car-loan-length/